A New Dawn at Rite Aid? Part 3 of 3

- Scott Klarquist

- Oct 15, 2019

- 9 min read

In our prior two blog posts from this month regarding Rite Aid Corporation (RAD) [for which, see here and here], we first examined the recent board and senior executive leadership changes at the company and then looked at RAD's recent Q2 FY2020 earnings report and the current state of the company's finances and operations. In this (3rd and final) post, we set forth four (4) immediate action items for RAD to pursue, namely:

(1) Repurchase more debt;

(2) Link up with a Goliath;

(3) Cut the corporate fat; and

(4) Change the company culture.

So, without further ado, below are our marching orders for RAD's revamped executive team and refreshed Board of Directors...

REPURCHASE MORE DEBT

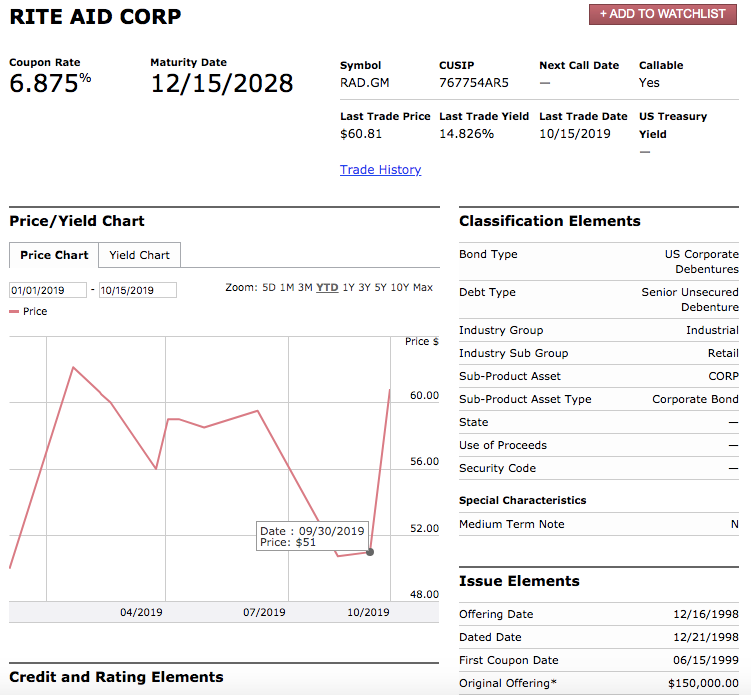

Clearly, RAD's leverage, most recently clocking in at ~6.8X (using the company's self-graded "Adjusted" EBITDA metric) is a major problem which potentially imperils the company. Leverage needs to come down--and fast. Thus, it was refreshing to see in today's Form 8-K filing that RAD is actively buying back its senior notes, both via negotiated purchases and private transactions. The company is tendering for up to $100 million aggregate principal amount of its outstanding 7.70% Senior Notes due 2027 and 6.875% Senior Notes due 2028 at just 61% of par value. Moreover, RAD bought back $84 million of these notes at the same price in a private transaction recently. Why might noteholders agree to this? Simple--these bonds were recently trading in the low 50s, so RAD is offering about 20% above the open market price (source here and here):

All told, the announced repurchases could eliminate $184 million of senior debt for just $112 million of cash, a gain of $72 million (over $1.30/share in value accretion to the shareholders). We applaud these moves by the company and believe RAD should repurchase the maximum permissible (under the revolver) amount of bonds at these depressed levels.

LINK UP WITH A GOLIATH

In order to prosper in the long run, RAD cannot really pursue a "go it alone" strategy, in our view. It is simply too small to compete with large-scale players like CVS and Walgreens. Yes, occasionally a David such as the 1970s era Walmart (WMT) comes along and defeats Goliath (at the time, K-Mart). One can also look at mid-1990s era Amazon (AMZN) as a good example of this phenomenon. However, the number of tiny players in the retail and/or pharmacy spaces that have floundered over the decades in the face of established competition dwarfs the number that have conquered like WMT and AMZN (see, e.g., this list of dead and dying retailers). One need only look at the downfall of pharmacy chain Fred's Inc. last month to see what the most likely final outcome of "go it alone" looks like:

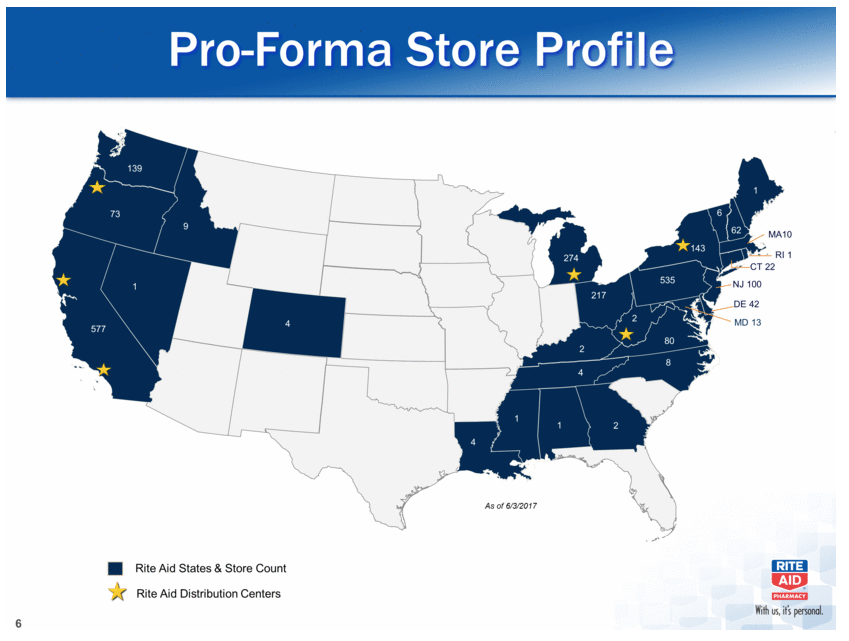

So what is the solution for RAD? Link up with a Goliath. We believe that a logical fit would be any of AMZN, WMT or Target (TGT), each of which has both retail and pharmacy operations and could benefit from acquiring RAD's stores/pharmacies. Does AMZN really want to disrupt the pharma and drug space, following its $753 million PillPack acquisition, which is now facing competitive pressure and pushback from WBA and CVS? Perhaps some or all of RAD's ~2,400 pharmacy network could be the key for them to achieve the necessary scale. Does AMZN want its cashierless store strategy, currently apparently mired in mud, to ramp up quickly? One journalist has noted that AMZN's slow rollout "might just be [attributable to lack of] good store locations. According to the documents, Amazon’s cashierless stores need high ceilings so the company can mount the cameras and sensors they use to detect which items a customer is buying. They also need to be near Amazon depots that carry fresh food, and they need to have decent foot traffic so customers are likely to stop by." Well, what company has leases in place for plenty of high-ceiling stores located along both coasts (i.e., near AMZN distribution centers)?

Yep, that would be Rite Aid [source here]:

Compare this to Amazon's distribution center map [source here]:

In fact, the two states that have the largest RAD store presence (post-WBA asset sale) are California (577 stores) and Pennsylvania (535 stores)...which also just happen to be the two states with the most AMZN distribution centers (18 and 12, respectively). Sounds like a match made in heaven--or, at least, capitalism.

We recommend that RAD's senior executive team IMMEDIATELY AND SIMULTANEOUSLY reach out to each of AMZN, WMT and TGT to begin discussions of a potential 50/50 joint venture into which RAD would contribute certain of its stores and pharmacies and in return would receive a commitment from the applicable deep-pocketed JV partner (whichever of these three offers the most compelling package to RAD) to fund the technological investments needed to go "cashierless" (note that adding RAD's network to any of these three would likely make their online, direct shipment offerings more compelling as well). If during negotiations AMZN tries to drive a hard bargain, simply give WMT or TGT the opportunity to steal a march on their juggernaut rival by outbidding AMZN. In other words, RAD executives will need to channel their inner Elon Musk in the negotiations, to wit: "'Do the impossible' is one of Tesla’s slogans, and Musk set out to make it happen [during the Gigafactory negotiations with various states]. He looked to spread the costs, seeking a mammoth package of incentives from states for the right to be the factory’s home. He succeeded—and then some. Musk landed a stunning $1.4 billion in tax breaks, free land, and other beneficence from Nevada to build the factory outside Reno. It’s one of the biggest gift baskets in history... Musk played an Oz-like role as master orchestrator, sending signals through earnings calls and blog postings, while keeping the states in the dark and playing on their fears of losing out. The combination of his strategy, the electric Musk factor, and the lure of 6,500 jobs inspired excited bidding among seven states and staggering leaps of faith. States were willing to move mountains (or highways, as the case may be) for a chance to have the factory". Great negotiations are not based on luck, as this example proves--negotiating well is an extremely valuable skill.

Importantly, for RAD shareholders to participate in the potential upside of such a link-up, the deal must be done in a JV format rather than a buyout of the entire company (unless a truly mind-boggling takeover proposal were advanced for all of RAD's equity--and by mind-boggling we mean triple digits). Even announcing a pilot program involving, perhaps, 20 or 30 RAD stores would be worthwhile to get the ball rolling and would likely cause RAD stock to quickly re-rate much higher. All of the foregoing might seem like a pipe dream to RAD shareholders today, given the relentless negativity surrounding the stock and the company in recent years, but often the proper long-term strategy for an upstart or "comeback kid" enterprise (RAD falls in the latter category) is to aim for a (nearly) impossible goal and push relentlessly to get there, the massive payoff justifying the effort. In other words, it's time to employ the "reality distortion field" at RAD (for once).

CUT THE CORPORATE FAT

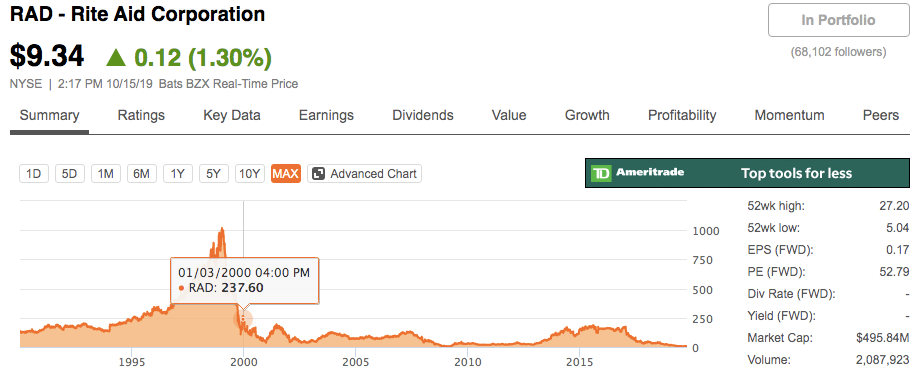

In order to prosper (either in its current state or post-JV), RAD clearly needs to reduce its level of corporate SG&A. We believe that several decades of stagnation, combined with a lack of accountability and efficiency, has resulted in a bloated and unappealing (for new hires as well as existing employees) corporate culture at Rite Aid. To cite Musk once more, RAD needs to scrape off the barnacles. Remember, the prior (failed) senior executive regime ran the company for most of the past 20 years, so it is no surprise that excessive sclerosis may have set in over that period. The stock price tells the sad tale, down 96% during this century (with zero dividends paid out) [note that AMZN is up over 2,000% during the same time period--or to put it more starkly, $10,000 invested in RAD on January 1, 2000 is now worth $393, enough to buy half of a men's suit at Hugo Boss, while the same amount invested in AMZN would now be worth $216,463, enough to buy a brand new, 3-bed 2-bath house in Austin, TX):

If we look at competitors WBA and CVS, for example, we find that RAD's SG&A line as a percentage of revenue is around 21%, whereas WBA's is at 18%. On $21.7 billion of revenue (RAD's guidance for FY 2020), an extra 3% means $650 million less flowing to the bottom line. Moreover, RAD disclosed that the 400 "corporate and field organization" employees laid off in early 2019 constituted just 20% of the total number of this category of employee, implying that pre-restructuring, RAD had a total of 2,000 "corporate and field organization" employees [source]:

A hallmark of a great company is maintaining a lean structure. While RAD sold approximately half of its stores to WBA, it has only reduced the number of corporate employees by 20%. Surely there is more fat to trim here. The new CEO should immediately prioritize further leaning out of the corporate overhead structure in order to get RAD's SG&A much closer to WBA's 18% of revenues.

CHANGE THE COMPANY CULTURE

Having great role models is incredibly important in life, as they can determine one's character ("character is destiny"). Even corporations can use a good role model or two to emulate. In our prior RAD Seeking Alpha article entitled "A MultiStep Rx For Rite Aid's Woes" [see full article & comments here], we argued that "now is a perfect time to refresh [RAD]'s staid corporate culture [by copying a] few examples of best practices from two demonstrably great companies, Amazon and Netflix". We specifically cited Bezos's 2016 AMZN shareholder letter, in which he said the following:

I work in an Amazon building named Day 1, and when I moved buildings, I took the name with me. I spend time thinking about this topic.

“Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”

To be sure, this kind of decline would happen in extreme slow motion. An established company might harvest Day 2 for decades, but the final result would still come.

I’m interested in the question, how do you fend off Day 2? What are the techniques and tactics? How do you keep the vitality of Day 1, even inside a large organization?

Such a question can’t have a simple answer. There will be many elements, multiple paths, and many traps. I don’t know the whole answer, but I may know bits of it. Here’s a starter pack of essentials for Day 1 defense: customer obsession, a skeptical view of proxies, the eager adoption of external trends, and high-velocity decision making.

Memo to RAD's new CEO and COO: INTERNALIZE JEFF BEZOS. READ HIS 2016 SHAREHOLDER LETTER--TWICE. NOW. PLEASE. DO IT. It will be by far the most important and rewarding thing you do all day.

[All of his other shareholder letters should also be read--for which, see here.] To further expand on the AMZN example, take Bezos on hiring:

One sign that RAD's corporate HQ folks simply haven't been working hard enough comes from our friends at Google. They handily allow us to get a glimpse of what is going on at HQ, located at 30 Hunter Lane, Camp Hill PA. First, take a look at ground level views of the campus from 2016 and 2017:

All seems relatively normal, cars are everywhere, people are seemingly working hard (or, at least, people are at work). But what happens when we look at a satellite view from 2019 (apparently taken on a weekend)? We find that virtually nobody can be bothered to put in any weekend overtime at this company (including the senior executives, who seem to have the prime parking spaces in the semi-circular driveway near the front entrance [third photo below]). We count a grand total of 5 cars in these shots, showing how minimal the "extra effort" is at RAD's Camp Hill HQ:

We are reminded of the old investment banker adage: "If you aren't coming in on Saturday, don't even think of coming in on Sunday". Except at Rite Aid HQ they apparently take this literally! Sorry, guys, but when you are a company in peril, with a large debt load coming due in a few short years, you need to bite the bullet and start working some (make that, most) weekends--even if you live in Camp Hill, PA. If it is good enough for AMZN, it's good enough for RAD. MEMO TO THE NEW CEO: CHANGE THE RITE AID CORPORATE CULTURE IMMEDIATELY TO ONE THAT DEMANDS ACCOUNTABILITY, PERFORMANCE, RELENTLESS EFFORT AND EMPHASIZES INTEGRITY FROM EVERY TEAM MEMBER, FROM ITS TOP LEADERS TO ITS STORE-LEVEL EMPLOYEES (NO EXCEPTIONS!).

CONCLUSION

We could cite many more items to put on RAD's senior leadership "to do" list, such as (1) schedule an Investor Day, (2) institute self-checkout kiosks in stores, (3) get a new board chairman, (4) institute a fundamentally re-thought and re-worked senior executive compensation system (that actually motivates executives to produce results rather than excuses [no more so-called "retention bonuses"!!!]), etc. However, we think intense focus is required of RAD's new CEO and COO, and their immediate reports, on a few key goals to get the company back on track after two decades of fairly continuous downward drift. We therefore recommend these folks focus 70-80% of their energy in the near term on the above four action items.

Disclosure: Long RAD.