SCC Portfolio Update (December 2020)

Seven Corners Capital's equity portfolio positioning as of December 1, 2020 was as follows, with the top-10 positions totaling 82% of the aggregate portfolio:

* = "PPS YE19" is average price paid in 2020 for positions that were initially established this year (i.e., TTSH, DISH & ZMTP)

The following is an update regarding earnings and other news for SCC's top-4 equity positions (PSHZF, TPB, MACK & TTSH) as of December 1, 2020 (these four constituted 58.5% of the value of the overall portfolio at such date):

Pershing Square Holdings (PSHZF), 30% position: Up 76% on the year as of 12/1, PSHZF is not only the largest, but has also been the 4th-best performing, position in the SCC portfolio. YTD through 11/30, PSHZF's NAV had increased nearly 77% gross (63% net) due mainly to portfolio manager Ackman's brilliant late February / early March CDS trade, which turned $27MM in premium payments into $2.6B in profits in approximately 2.5 weeks (see PSHZF's explanation of the trade here). This translates into a CAGR of something on the order of 190,000%(!). PSH will also officially added to the FTSE 100 effective as of 12/18/2020, which should hopefully reduce the yawning ~25-30% NAV discount that has consistently afflicted the company's stock over the past few years (one would expect this discount to close given that major index funds will effectively become forced buyers of the security; moreover, traders will likely establish positions prior to such date in anticipation of this forced buying (see further here and here)). Below are the most recent NAV statistics for PSH:

For reference, below please see Pershing Square Capital Management's 13-F holdings as of 9/30/2020. The portfolio, consisting of only 8 holdings (note that the 13-F doesn't list Pershing's FNMA/FMCC holdings for some reason), is quite concentrated, although Ackman recently put back on PSH's CDS trade at a lower level than the spring.

Turning Point Brands (TPB) (fka Standard Diversified (SDI)), 17% position: SCC's prior SDI position (14% of the portfolio as of Q1) became a position in Turning Point Brands shares in mid-July 2020, with each share of SDI Common Stock being exchanged for 0.52 shares of TPB Common Stock:

TPB, a leading U.S. provider of Other Tobacco Products and adult consumer alternatives, reported strong Q3 earnings on October 27th (see full PR here):

TPB submitted their pre-marketing application for e-cigarettes and similar devices to the FDA in September 2020, providing its investors with the following update: "On September 8, 2020, TPB announced it had submitted to the U.S. Food and Drug Administration (“FDA”) Premarket Tobacco Applications (“PMTAs”) covering 250 products, an important and necessary step for TPB to offer adult consumers an extensive portfolio of products that serve as alternatives to combustible cigarettes and satisfy a wide variety of consumer preferences. The PMTAs covered a broad assortment of products in the vapor category including multiple proprietary e-liquid offerings in varying nicotine strengths, technologies and sizes; proprietary replacement parts and components of open system tank devices through partnerships with two leading manufacturers for exclusive distribution of products in the United States; and a closed system e-cigarette. The PMTAs provided clarity to customers and retail partners of TPB’s continued support behind products across multiple leading brands including Solace™, VaporFi®, South Beach Smoke™, HorizonTech®, FreeMaX® and other developing brands and partnerships." Per the FDA's website, "A PMTA must provide scientific data that demonstrates a product is appropriate for the protection of public health" (see here). TPB investors could thus see meaningful revenue growth in future years if the company receives FDA approval for a number of its 250 new product candidates.

TPB projects the 2020 net sales to be $395 to $401 (up significantly from Q1 guidance of $338 to $353 million) and 2020 Adjusted EBITDA to be $87 million to $90 million (Q1: $69 to $75 million). The company's management clearly continues to operate the business on all cylinders, with potential PMTA approval(s) waiting in the wings for 2021. Please see the latest TPB investor presentation here.

Merrimack Pharmaceuticals (MACK), 7% position: Up 27% during 2020 as of 12/1, MACK is a classic "discount to the sum-of-the-parts" play. It can be good to have one or more of these plays interspersed with one's general long holdings, since (theoretically, at least) investors should view them without regard to rises or falls in the overall market. With no debt and a cash runway which the company claims should last until 2027, and with underlying business operations having basically ceased, MACK retains approximately $500MM of face value worth of contingent value rights (or CVRs) on its balance sheet, representing a maximum potential value to MACK holders of up to $37/share, compared to a recent stock price of $4.00. If the company fails to monetize the CVRs in the near term by selling them to a third party buyer, shareholders will likely have to wait 2 to 3 years for the underlying drug trials to read out in order to determine whether and how much the CVRs will pay out (however recent disclosures by Ipsen indicate that at least one of these read-outs could occur sooner than previously expected). FWIW, insiders have buying quite heavily in recent months (see full list of insider transactions here):

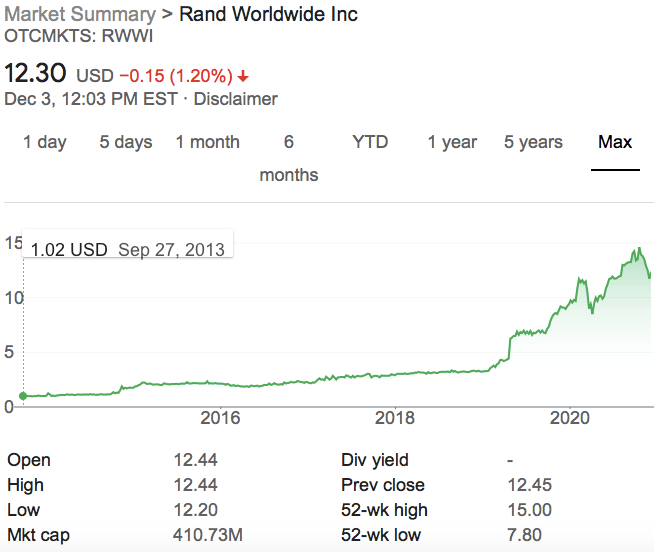

Tile Shop Holdings (TTSH), 5% position: Up 173% thus far since establishing the position in Q1 of 2020, rather than being a bet on a business model, TTSH frankly represents a bet on investor and ValueAct Capital co-founder Peter Kamin, who currently owns 6.7 million Tile Shop shares (13.2% of TTSH's equity) and as board chairman is effectively now in control of the company. Put succinctly, Kamin is a home run hitter. For example, since his initial investment over eight years ago as a large (>5%) holder of Rand Worldwide (RWWI) at an average cost of sub-$1/share (at last check, he controlled almost 60% of the company's shares), the stock as gone up over 10X:

Kamin also was a heavy buyer of Orion Energy Systems (OESX) in 2018 at sub-$1 prices (see here and here), which security has subsequently appreciated approximately nine-fold. Note that smart money player B Riley Financial has also recently established a large position in Tile Shop (see here).

TTSH announced its Q3 earnings on November 5th (see full earnings PR here):

Impressively, despite the pandemic, leverage is way down since the beginning of 2020, when the company had $63MM of LT debt (as of 9/30/2020, the company had just $7MM). FCF for the 1st 9 months of 2020 was $56MM, versus a current market cap of just $232MM, implying that TTSH could (in relatively short order) begin returning excess capital to shareholders via dividends or share repurchases. In addition, per a comprehensive legal settlement entered into during Q3, TTSH agreed to (A) pay $12MM to certain class-action plaintiffs and (B) institute various corporate governance reforms as follows (see full settlement details here):

Directors Jacullo, Kamin and Rucker agreed to extend their previously-disclosed standstill commitments (see Company’s Form 8-K dated January 10, 2020) until at least June 1, 2023;

The Company will continue to provide OTC disclosure at or above the level characterized as “Pink Sheet: Current Tier” for until the earlier of three years after the effective date of the Settlement Agreement or until such time as the individual defendants no longer serve on the Board of Directors of the Company (the “Board”);

All shares purchased by Messrs. Kamin and Jacullo or entities affiliated with them between October 23 and November 8, 2019 shall be voted in the same proportion as the vote of shares held by Outside Stockholders (as defined by the Settlement Agreement) for three years from the date of purchase or until sold;

The Company’s Insider Trading Policy shall be modified to extend the period before insiders can begin trading after a public announcement of material information;

Subject to stockholder approval, the Company’s Certificate of Incorporation and Bylaws will be amended to expand the approval rights of public shareholders who are not directors and officers and to establish an Independent Transaction Committee of the Board of Directors, which shall initially be comprised of Mark Bonney and Linda Solheid; and

Mark Bonney shall serve as the chair of the Board’s Audit Committee and Independent Transaction Committee for a period of three years.

DISCLOSURE: Long all of the above.

Comments